Inside the 2025 iGEM Startups Cohort: Sector Distribution, Key Trends and Highlights

Every year, iGEM startups is dedicated to supporting aspiring BioFounders to explore entrepreneurship, and bridge the gap between ideas and impact within synthetic biology projects. Through the Venture Foundry program, our aim is to engage with scientists and introduce concepts of entrepreneurship and commercialisation in a research-driven context.

In 2025, 85 teams were welcomed into our flagship program, the Venture Creation Lab (VCL), which ran across three regions: Asia-Pacific (APAC), Europe, Middle East and Africa (EMEA), and the Americas. Over the last 6 years, teams participating in the VCL have been broadly classified into seven sectors: Agriculture and Food, Artificial Intelligence (AI), Bioinformatics and Software, Diagnostics and Therapeutics, Environmental and Climate, MedTech and Health, Education and Knowledge Platforms, and Biomanufacturing (Figure 1).

Figure 1| Distribution of iGEM Startups by sector from 2019-2025.

On a global scale, there has been an increase towards MedTech & Health, Environmental & Climate, and the Biomanufacturing sectors, supported by innovation in AI. These trends are subject to regional variations within APAC, the Americas and EMEA, each demonstrating unique strengths and opportunities.

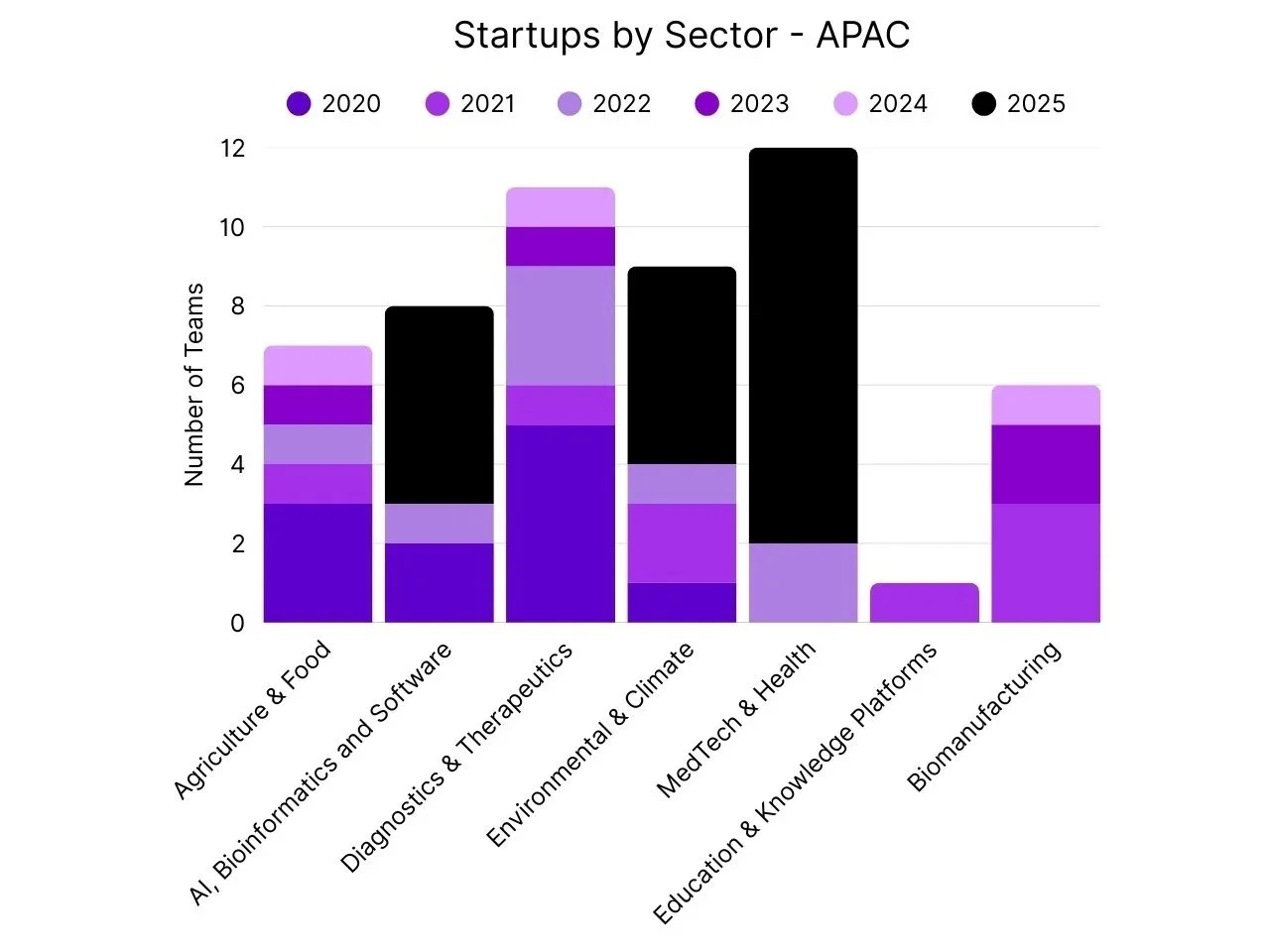

APAC: Surge in MedTech and Health and (Essential Oil) Biomanufacturing

The APAC Cohort saw a remarkable eight-fold increase this year, growing from 3 teams in 2024 to 26 teams in 2025. Key growth sectors included AI, Bioinformatics and Software, MedTech & Health, and Environmental & Climate (Figure 2).

Figure 2| iGEM Startups sector distribution in APAC.

MedTech & Health dominated in APAC, with 10 teams addressing diverse innovations, from AI-enabled diagnostics, to sustainable treatments like phage systems and biopolymers. Reverra Therapeutics (Indonesia, VCL Grand Prize) is developing a novel antibody-drug conjugate to improve on the current monoclonal antibody market for dementia.

The increase in MedTech startups mirrors broader global trends, as APAC has emerged as one of the most promising markets in the global MedTech landscape. In 2024, the region accounted for approximately 22.9% of global MedTech revenue, with a projected CAGR of 8.4% through to 2029 (Life Science Intelligence, 2025). Key drivers include government incentives aimed at promoting domestic manufacturing, a rise in local innovation and regulatory shifts favoring local manufacturers. Countries such as China, Japan, India and South Korea are starting to dominate the MedTech sector through stringent regulation policies that have a preference of domestic suppliers (Asia Pacific Medical Technology Association, 2025).

In the Environmental & Climate sector, several teams focused on the bioproduction of essential oils to decrease the environmental impact of oil extraction. PETal (India) is tackling sandalwood oil production. Over the last 75 years, India’s sandalwood population has dropped from 900,000 hectares to 20,000 hectares. The team aims to engineer microbes for sandalwood oil biosynthesis, protecting natural resources from overconsumption. Fructo Biologics (Indonesia) aims to improve oil content in palm fruit by supplying essential nutrients like potassium, zinc and boron. This could dramatically reduce the demand for palm fruit harvesting and subsequently decrease deforestation rates. This scientific shift is not just eco-friendly, but commercially significant. APAC’s natural and essential oil market is expected to reach $3.63 billion USD by 2030, making it the fastest growing regional market (Mordor Intelligence, 2024).

AI, Bioinformatics and Software teams focused on creating machine learning tools to enhance wet lab research efficiency. Notably, Miyama, an India-based team, developed a chat-based electronic lab notebook (ELN) to help synthetic biologists navigate data-heavy omics experiments.

Overall, the remarkable rise of the APAC cohort highlights both the region’s growing government incentive towards synthetic biology and its potential to address regional challenges in environment and health.

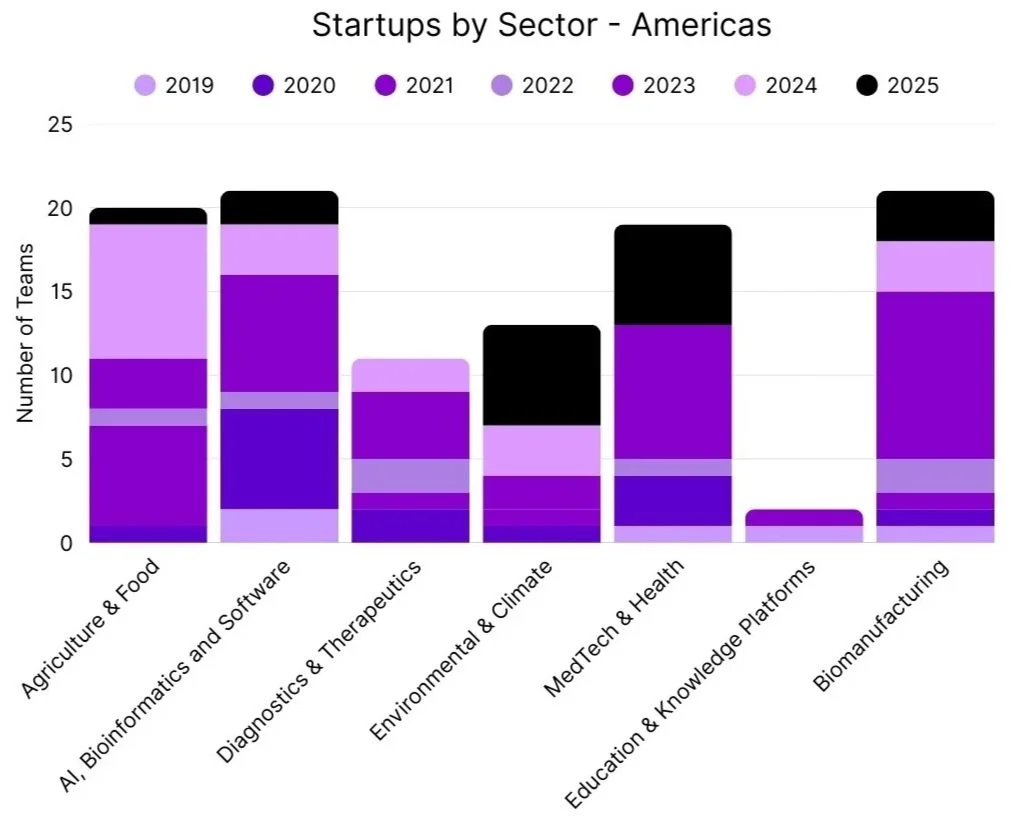

The Americas: Focus on Sustainable Agriculture and AI-driven Biomanufacturing

This year, eighteen teams joined from the Americas. The Environmental & Climate sector experienced the largest growth compared to 2024, closely followed by the MedTech & Health and Biomanufacturing sectors (Figure 3).

Figure 3| iGEM Startups sector distribution in the Americas.

The Agriculture and Food & Beverage sub-sectors were the dominant sub-sectors in the Environmental & Climate startups. Several startups working at the intersection between Environmental & Climate solutions and Agriculture & Food sectors are based in South America. South America is a growing global powerhouse in agriculture, driven by significant exports of products such as corn, beef and soybeans (Statista, 2025). The increase in sustainable agriculture teams highlights the strength of South America’s startup ecosystem in supporting innovation within the sector.

Notable highlights of this sector:

Agrinova (United States, VCL Grand Prize) is developing bacterial biosensors for heavy metal detection to tackle soil contamination in urban farming.

AgroPip (Mexico, VCL Most Innovative Solution) is engineering biopesticides targeting fall armyworm, decreasing toxic pesticide use while also improving food security.

AureoBos (Mexico) is developing intramammary infusions made out of recombinant proteins to treat bovine mastitis, a bacterial infection that harms cows and reduces milk production.

The Americas also stood out for their extensive use of AI in Biomanufacturing. IGNIS (Mexico) is building an AI agent for the assisted design of high-performing microbial cell factories, while AlariaAI (United States) is creating an AI-enabled cell expansion platform. According to an MIT policy briefing, federal agencies in the region are moving towards the creation of shared tools, resources, and systems to allow for data sharing and modeling in biomanufacturing (Love et al., 2025). AI will be a necessary tool for the scale-up for biomanufacturing, positioning these startups at the forefront of the bioeconomy.

EMEA: Next-Gen Therapeutics and Diagnostics

Eighteen teams from EMEA participated this year, with MedTech & Health emerging as the dominant sector (Figure 4).

Figure 4| iGEM Startups by Sector in EMEA.

Most teams in the EMEA MedTech & Health sector were based in Germany. The German pharmaceutical market is the largest in Europe, generating significant revenue and promising strong growth through 2030 (Germany Trade & Invest, 2025). NeuraNova (Germany, Best Participation Prize) explored the intersection of MedTech & Health and Therapeutics. This team aims to boost CNS-regeneration as a therapeutic for neurodegeneration, with the market projected to grow by 7.14% in the next 5 years (Mordor Intelligence, 2025).

There was also a notable gain in interest in novel diagnostic tools. LIQSENS (France) utilizes continuous protein biomarker monitoring for the early-detection of heart failure. Healen (Germany), is developing a lab-on-a-chip solution for the diagnosis and personalization of drug testing of endometriosis, aligning with the lab-on-a-chip market growing nearly 10% annually (Grand View Research, 2025).

Key Takeaway for 2025: The Rise of AI in Healthcare.

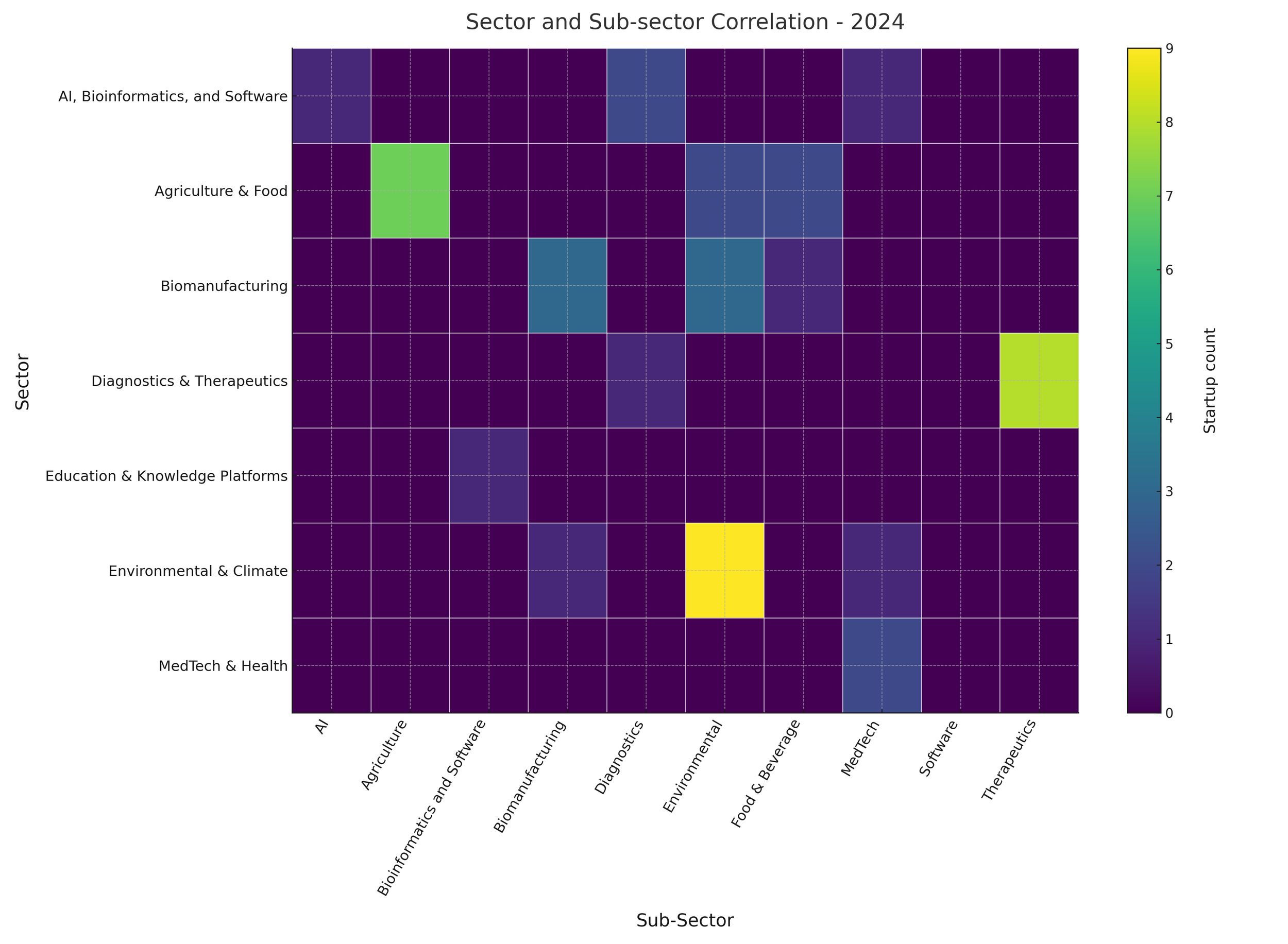

Synthetic biology is inherently interdisciplinary, and a key trend from the 2025 cohort is the global shift towards the use of AI in healthcare development (Figure 5 and 6). While the convergence of AI with synthetic biology was already visible with the 2024 cohort (iGEM Startups, 2024), the intersection of healthcare and AI stands out particularly this year.

Figure 5| Pairwise correlations of sectors and sub-sectors in 2024.

Figure 6| Pairwise correlations of sectors and sub-sectors in 2025. There was a significant increase in the number of startups at the intersection of MedTech & Health and AI.

In the 2025 EMEA cohort, 4 of the 11 MedTech & Health startups were classified under the AI sub-sector - the highest number of any region. EndostiX (EMEA-wide, Best Presentation) is developing a modelling-based diagnostic tool for endometriosis using a non-invasive, multi-omics approach and RepurOmixAI (EMEA-wide, Most Innovative Solution) is harnessing AI and multiomics to advance drug discovery pipelines.

Globally, the MedTech & Health sector combined with AI has experienced the fastest growth among all sector/sub-sector pairs across iGEM regions since 2024. In commercial markets, AI and advanced Machine Learning applications in MedTech are rapidly expanding, with applications ranging from clinical validation to device design and engineering. In 2024, the global market size for AI in healthcare was valued at $29.01 billion USD and projected to grow to $504.17 billion USD by 2032 (Fortune Business Insights, 2025), making it significantly attractive for both biofounders and investors.

Conclusion

In conclusion, the 2025 iGEM Startups Venture Creation Lab cohort highlights the accelerating global momentum of synthetic biology, with record participation across the APAC region. Key growth sectors include MedTech & Health, Environmental & Climate and AI-driven synthetic biology tools, reflecting both regional strengths and global market opportunities. From sustainable agriculture to cutting-edge therapeutics, teams are addressing urgent societal and environmental challenges with creativity and measurable impact.

Fifteen teams will be selected to present their pitch at the Startups Showcase during the 2025 Grand Jamboree, which will take place October 28-31, 2025, at the Paris Convention Centre.

Get your tickets to the 2025 iGEM Grand Jamboree, which include universal access to all events, including the BioInnovation Fair, here.